Current Affairs Of Today Are

1) Airborne Rescue Pod for Isolated Transportation (ARPIT)

- The Indian Air Force has designed, developed, and inducted an Airborne Rescue Pod for Isolated Transportation (ARPIT). This pod will be utilized for the evacuation of critical patients with infectious diseases including COVID-19 from high altitude areas, isolated and remote places.

- The requirement of an air evacuation system with a facility to prevent the spread of infectious aerosol from a COVID-19 patient during air travel was felt by IAF when COVID-19 was declared as a pandemic. The first prototype was developed at 3 BRD AF and has undergone various modifications. This indigenously designed system has been developed for Rs Sixty Thousand only, which is very less as compared to the imported systems costing up to Rs Sixty Lakh.

- The system has been developed as a lightweight isolation system made from aviation certified material. It has a transparent and durable cast Perspex for enhanced patient visibility which is larger, higher, and wider than the existing models. The isolation system caters to a suitable number of air exchanges, integration of medical monitoring instruments, and ventilation to an intubated patient. Also, it generates high constant negative pressure in the isolation chamber for the prevention of infection risk to aircrew, ground crew, and health care workers involved in air transportation. The ARPIT utilizes High-Efficiency Particulate Air (HEPA) H-13 class filters and supports invasive ventilation using Transport Ventilator. The design integrates life support and monitoring instruments (defibrillator with multipara monitor, pulse oximeter, Infusion pumps, etc), long arm gloves for use by health care professionals, and power pack with high endurance. Design requirements have been evolved and are based on the guidelines issued by the Ministry of Health and Family Welfare (MoHFW), National Accreditation Board for Hospitals & Healthcare Providers (NABH), and Centre for Disease Control (CDC), USA. The IAF is inducting a total of 7 ARMPITS as of now.

Source: PIB

2) India and Denmark sign MOU for developing cooperation between two countries in the power sector

- The Memorandum of Understanding on Indo-Denmark Energy Cooperation between the Ministry of Power, Government of the Republic of India and the Ministry for Energy, Utilities and Climate, Government of the Kingdom of Denmark to develop a strong, deep and long-term co-operation between two countries in the power sector based on equality, reciprocity and the mutual benefit was signed on 5th June 2020.

- The MoU provides for collaboration in areas like offshore wind, long term energy planning, forecasting, flexibility in the grid, consolidation of grid codes to integrate and operate efficiently variable generation options, flexibility in the power purchase agreements, incentivize power plant flexibility, variability in renewable energy production, etc. The Indian electricity market would benefit from cooperation with Denmark in these areas.

- For the implementation of the identified areas, a Joint Working Group (JWG) will be established under the MoU. The JWG will be co-chaired by Joint Secretary level officials and will report to a Steering Committee, jointly chaired by the Secretary level officer from both the sides.

- The Governments will endeavor to take necessary steps to encourage and promote strategic and technical co-operation in the power sector for mutual benefit in the identified areas through the MoU.

Source: PIB

3) Mahatma Gandhi Employment Guarantee Act

- A provision of Rs. 1,01,500 crore has been made under Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) in the current financial year 2020-2021. It is the highest ever provision of funds under the program.

- A sum of Rs. 31,493 crore has already been released in 2020-2021, which is more than 50% of the budget estimate of the current Financial Year.

- A total of 60.80 crore person days has been generated so far and work has been offered to 6.69 crore persons. An average number of persons to whom work offered in May 2020 has been 2.51 crore per day, which is 73% higher than the work offered in May last year, which was 1.45 crore persons per day.

- A total of 10 lakh works have been completed so far during the current Financial Year 2020-2021. A sustained focus is on taking up works related to water conservation and irrigation, plantation, horticulture, and Individual Beneficiary works for livelihood promotion.

About MGNREGA:

- The scheme was introduced as a social measure that guarantees “the right to work”. The key tenet of this social measure and labor law is that the local government will have to legally provide at least 100 days of wage employment in rural India to enhance their quality of life.

Key objectives:

- Generation of paid rural employment of not less than 100 days for each worker who volunteers for unskilled labor.

- Proactively ensuring social inclusion by strengthening the livelihood base of the rural poor.

- Creation of durable assets in rural areas such as walls, ponds, roads, and canals.

- Reduce urban migration from rural areas.

- Create rural infrastructure by using untapped rural labor.

The following are the eligibility criteria for receiving the benefits under the MGNREGA scheme:

- Must be Citizen of India to seek NREGA benefits.

- Jobseeker has completed 18 years of age at the time of application.

- The applicant must be part of a local household (i.e. application must be made with local Gram Panchayat).

- The applicant must volunteer for unskilled labor.

Key facts related to the scheme:

- The Ministry of Rural Development (MRD), Govt of India is monitoring the entire implementation of this scheme in association with state governments.

- Individual beneficiary oriented works can be taken up on the cards of Scheduled Castes and Scheduled Tribes, small or marginal farmers or beneficiaries of land reforms or beneficiaries under the Indira Awaas Yojana of the Government of India.

- Within 15 days of submitting the application or from the day work is demanded, wage employment will be provided to the applicant.

- The right to get an unemployment allowance in case employment is not provided within fifteen days of submitting the application or from the date when work is sought.

- Social Audit of MGNREGA works is mandatory, which lends to accountability and transparency.

- The Gram Sabha is the principal forum for wage seekers to raise their voices and make demands.

- It is the Gram Sabha and the Gram Panchayat which approves the shelf of works under MGNREGA and fixes their priority.

Role of Gram Sabha:

- It determines the order of priority of works in the meetings of the Gram Sabha keeping in view the potential of the local area, its needs, local resources.

- Monitor the execution of works within the GP.

Roles of Gram Panchayat:

- Receiving applications for registration

- Verifying registration applications

- Registering households

- Issuing Job Cards (JCs)

- Receiving applications for work

- Issuing dated receipts for these applications for work

- Allotting work within fifteen days of submitting the application or from the date when work is sought in the case of an advance application.

- Identification and planning of works, developing shelf of projects including determination of the order of their priority.

Responsibilities of State Government in MGNREGA:

- Frame Rules on matters about State responsibilities under Section 32 of Act ii) Develop and notify the Rural Employment Guarantee Scheme for the State.

- Set up the State Employment Guarantee Council (SEGC).

- Set up a State level MGNREGA implementation agency/ mission with an adequate number of high caliber professionals.

- Set up a State level MGNREGA social audit agency/directorate with an adequate number of people with knowledge on MGNREGA processes and demonstrated commitment to social audit.

- Establish and operate a State Employment Guarantee Fund (SEGF).

Source: PIB

4) Global Economic Prospects (GEP) June 2020

- The Indian economy is expected to contract by 3.2% in this fiscal year as a result of the COVID19 pandemic and its associated restrictions, the World Bank said in its Global Economic Prospects (GEP) June 2020 report. Growth is forecast at 3.1% next year.

- The world economy, as a whole, is set to witness its deepest recession since World War II, with a forecasted contraction of 5.2% this year — some 60 million could be pushed into extreme poverty, World Bank Group President David Malpass had warned. With updated data now available, this number could be 70-100 million, a Bank economist told

- Emerging market and developing economies (EMDEs) are expected to contract by 2.5% this year, and economic activity in advanced economies is forecast to shrink by 7%, as domestic supply and demand, finance, and trade have been disrupted due to the pandemic. Countries most reliant on global trade, tourism, external financing, and commodity exports are likely to be hit the hardest.

- In the baseline scenario, global growth is set to rebound at 4.2% in 2021, with EMDEs growing at 4.6% and advanced economies growing at 3.9%.

- This, however, is the baseline forecast and assumes that pandemicinduced domestic restrictions will be lifted by midyear in advanced economies and a bit later in EMDEs.

- The downside scenario is more severe — the global economy could shrink this year by as much as 8% (5% for EMDEs), followed by weak recovery at just above 1% growth next year.

India's Growth

- India’s growth is estimated to have slowed to 4.2% in FY 2019-20 (year ended March 31, 2020). The output is expected to contract by 3.2% (so growth is 3.2%) in FY2020-21, as the impact of the pandemic (the restrictions on activity) will largely fall in this year, despite the fiscal and monetary stimulus.

Balance sheet stress

- The growth forecast for this fiscal year is 9 percentage points lower than the GEP forecasts from January 2020, when the forecast for this fiscal was a (positive) 5.8% — the world was not yet in the grip of the pandemic.

- Spillover effects from weak global growth and balance sheet stress are also weighing down on economic activity, as per the report. India is forecast to see some recovery next year and grow at 3.1%.

Source:

Mint

5) miR-155: Role in growth and spread of tongue cancer cells

- Researchers at the Indian Institute of Technology Madras have identified a specific microRNA (miRNAs) called ‘miR155’ that is overexpressed in tongue cancer. The research team has shown that knocking out miR-155 causes the death of cancer cells, arrests the cell cycle and regresses tumor size in animal models, and reduces cell viability and colony formation in benchtop assays.

- The finding could help develop molecular strategies to manipulate miR155 expression to develop therapeutics for tongue cancer.

- The miRNAs affect cancer growth through inhibiting or enhancing the functions of certain proteins.

- MicroRNAs (miRNAs) are short noncoding RNAs containing 20–24 nucleotides that participate in virtually all biological pathways in animals. They have been found to play important roles in many cancers, in carcinogenesis (start of cancer), malignant transformation, and metastasis — the development of secondary cancer. The miRNAs associated with cancer are called ‘Oncomirs’

- Many of the Oncomirs affect cancer by suppressing the performance of tumor-suppressing agents. Some of them can prevent the growth and spread of cancer cells and yet others prevent tumor growth itself

- miRNA manipulation is being combined with conventional cancer treatment methods such as chemotherapy, radiotherapy, and immunotherapy.

Source:

The Hindu

6) An affordable ultraviolet-C (UVC) shoe sole sanitizer

- An affordable ultraviolet-C(UVC) shoe sole sanitizer, developed by the Industrial Training Institute (ITI) in Odisha’s Berhampur was formally launched via video conference, and its first unit was handed over to a COVID19 hospital at Sitalapalli on the outskirts of the city

- The threat of transmission of pathogenic viruses and microbes through the soles of footwear is extremely high at hospitals and public places like schools, offices, airports, railway stations, shopping malls, and hotels

- The innovation costs ₹6,000-₹7,000. Similar sole sanitizers are marketed for USD 5,000 in America, and some private companies in India are selling such devices at ₹50,000

- The device includes a covered portable platform with a shoe sole receiving surface. When a person stands on it and places his or her shoe soles on the surface, a timer unit lights up the UVC lamps underneath, which direct UVC rays for eight seconds to eradicate microorganisms on the soles.

- Out of three types of UV radiations named UVA, UVB and UVC, short-wavelength UVC damages and alters DNA of all potentially harmful microbes, including viruses, making them incapable of replication. To avoid leakage of UVC harmful to human eyes, the device has a leakproof cover over the chamber where the footwear is placed.

- The standard device can disinfect the soles of both shoes at a go. A cheaper, single chamber unit has also been developed, in which soles can be disinfected one after the other. Its affordability ensures the device can be used in shops and homes as well.

7) Darbuk-Shyok-Daulat Beg Oldie Road

The Darbuk-Shyok-Daulat Beg Oldie (DSDBO) road has been in the making for

around two decades and is expected to be completed by 2020.

Key Points

- The 255-km road from Darbuk traverses at an altitude of 14,000 feet and reaches Shyok, the last Indian village in the region.

- This road joins Leh to the Karakoram Pass, which divides Ladakh from China’s Xinjiang province.

- Between Shyok and Karakoram Pass lies Daulat Beg Oldie (DBO), a plateau at an altitude of over 16,000 feet, and the location of an Advanced Landing Ground (ALG) used by the air force to drop supplies.

- DBO is India’s northernmost corner, which in army parlance is called Sub-Sector North.

- Background:

- The road’s construction was started in 2000 and was to be completed by 2012 for Rs. 320 crore under the monitoring of the Prime Minister’s Office (PMO).

- However, the construction could not be finished as the road was aligned with the Shyok riverbed that led to it being damaged every summer during flooding.

- Later, major portions of the road were realigned, keeping them away from the river.

- In October 2019, the 430 m Colonel Chewang Rinchen Setu over the Shyok river was inaugurated that joins Durbuk to DBO in Eastern Ladakh.

- Along with it, the Siachen Glacier area of Ladakh was declared open for tourists by the Government of India.

- India has decided to not stop road construction on its side of the Line of Actual Control (LAC) despite the border confrontations and objections by China as it does not want India to utilize the DSDBO road to its full potential.

- Significance of the Road:

- DBO has located only 9 km away from the LAC with China and the road will help manage the border and the areas adjoining Aksai Chin, Chip Chap River, and Jiwan Nalla.

- It will also ensure faster deployment of troops in the area.

- Before the laying of the road, the only way to reach the area was via the ALG, where heavy-lift aircraft can land.

- From the DSDBO road, a road branches off towards Galwan Valley which had prompted the stand-off in Galwan Valley.

- Indian troops have been patrolling up to this area but they will have road access and can be present there.

Way Forward

- In the Wuhan (2018) and Mahabalipuram (2019) summits, both India and China had reaffirmed that they would make efforts to ensure peace and tranquillity in the border areas.

- On 1st April 2020, India and China completed their 70 years of diplomatic relations. Both countries have resolved border issues peacefully in the past four decades which gives them hope that the tensions will subside soon.

- India and China are amongst the largest economies, demography, markets, and militaries of the world. Therefore, it is in the interests of both countries to align their energies for the growth and development of their people, region, and global peace.

Source:

Economic Times

8) Shapes of Economic Recovery

As India is going to come out of the Covid-19 lockdown, experts are debating

over the shape of recovery of the Indian economy.

Key Points

- The economists are unanimous that in the current financial year 2020-21, India’s economy will contract.

- According to the World Bank’s South Asia Economic Focus report, India’s growth is likely to remain at 1.5-2.8% in 2020-21 which is the slowest since the 1991 economic reforms.

- Many economists are also of the opinion that after hitting the bottom this year, the Indian economy will start its recovery in the next financial year (2021-22).

- However, according to an analysis by Pronab Sen, former Chief Statistician of India, India’s economy will contract not just in the financial year 2020-21 but also in 2021-22.

- This means that India could experience a full-blown depression – the first in India’s history as an independent nation.

- The Table shows India’s absolute Gross Domestic Product (GDP) is likely to struggle to even come back to the 2019-20 level by 2023-24.

- India is likely to end up with an “elongated U-shape” recovery due to the weakness of the economy going into the Covid crisis as well as the inadequate fiscal stimulus measure taken by the government.

- The Table also provides a snapshot of the likely trend level of GDP had India grown at 6% and 8% respectively over the same period.

- Other economists are of the view that it is difficult to predict the shape of economic recovery in India at this juncture as there are too many unknowns.

- If there is no second wave of Covid-19, India can expect swift normalization from negative growth levels to the pre-covid levels of 5% and a gradual recovery to 7% by the second half of the next fiscal (2021-22).

Types of Shape of Economic Recovery

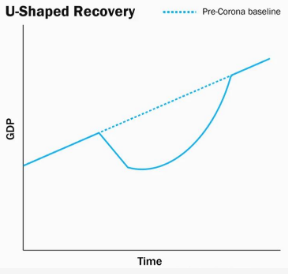

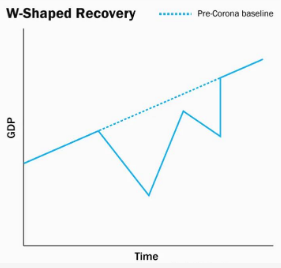

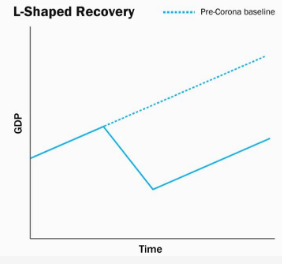

- Economic recovery can take many forms, which is depicted using alphabetic notations. For example, a Z-shaped recovery, a V-shaped recovery, a U-shaped recovery, an elongated U-shaped recovery, a W-shaped recovery, and an L-shaped recovery.

- The alphabets generally denote the graph of growth rate, which resembles the shape of the letter.

- The fundamental difference between the different kinds of recovery is the time taken for economic activity to normalize.

- The time taken is often a factor of multiple things such as the depth of the economic crisis. e.g deeper the recession, longer is the time to get back to normal.

- The other aspect of economic recovery includes the effect of a pandemic on jobs and household incomes and the kind of policy response taken by the government that determines how quickly economic growth will recover.

- Z-shaped recovery: It is the most optimistic scenario in which the economy quickly rises after an economic crash.

- It makes up more than for lost ground before settling back to the normal trend-line, thus forming a Z-shaped chart.

- In this economic disruption lasts for a small period wherein more than people’s incomes, it is their ability to spend is restricted.

- V-shaped recovery: It is the next-best scenario after Z-shaped recovery in which the economy quickly recoups lost ground and gets back to the normal growth trend-line.

- In this, incomes and jobs are not permanently lost, and the economic growth recovers sharply and returns to the path it was following before the disruption.

- U-shaped recovery: It is a scenario in which the economy, after falling, struggles around a low growth rate for some time, before rising gradually to usual levels.

- In this case, several jobs are lost and people fall upon their savings.

- If this process is more-long drawn than it throws up the “elongated U” shape.

- W-shaped recovery: A W-shaped recovery is a dangerous creature. In this, growth falls and rises, but falls again before recovering, thus forming a W-like chart.

- The double-dip depicted by a W-shaped recovery can be due to the second wave of the pandemic.

- L-shaped recovery: In this, the economy fails to regain the level of GDP even after years go by.

- The shape shows that there is a permanent loss to the economy’s ability to produce.

Source:

Indian Express

9) Persian Gulf Region

The Persian Gulf region has the presence of the major producers of crude

oil and natural gas, and thereby contributing critically to the global

economy.

- Thus, maintaining peace in the geopolitically significant region through cooperative security by the regional members and major world economies is one of the best solutions to stabilize the region politically and economically.

Background

- British Era:

- For eight decades before 1970, the Persian Gulf was guarded as a ‘British Lake’.

- After the end of the British era, regional players entered with the intra-regional rivalries and forced cooperation.

- Aggravated Political Tensions in the Region:

- Events like the Muscat conference (1975), Iranian Revolution (1979), and the Iraq-Iran War (1980) aggravated the political tensions in the region. Subsequently, it enhanced the USA’s interests and roles in the region.

- The Muscat Conference (1975) was intended to develop the unified army cooperation to enhance the security among gulf states to guarantee free navigation in the Persian Gulf.

- Later, the United Nations Security Council Resolution 598 (1987) was adopted to ensure a ceasefire between Iran and Iraq specifically and to explore measures to enhance the security and stability in the region generally.

Current Scenario

- Rising Conflicts in the Region:

- Recently, the geopolitical factors and conflicts in the West Asian region — Yemen, Syria, Libya — aggravated global and regional relationships.

- Declining Role of USA:

- The above-mentioned conflicts have hampered USA-Iran relations that were to be premised on the multilateral agreement on Iran’s nuclear program agreed to by western powers.

- The declining USA’s commitment to sub-regional security has raised more issues among the members of the Gulf Cooperation Council (GCC) due to political and ideological disagreement with Iran.

- Emerging Split Within GCC:

- The recent emergence of conflicting tactical and strategic interests and subjective considerations has created a division among the members of the GCC.

- These divisions in the GCC are being aggravated due to following reasons:

- Global economic crisis

- The immediate and longer-term impact of Covid-19 on regional economies

- Problems in the Organization of the Petroleum Exporting Countries (OPEC)

- The decline in oil prices

Possible Stability Framework for the Region

- Regional as well as Global Security:

- Any possible framework for stability and security in the region needs to ensure the security not only on the regional terms but also on global terms.

- Because the gulf regional security is not an issue among the Gulf States themselves but it is also an external issue.

- Other Aspects:

- Additionally, the framework will also need to ensure the following conditions which include:

- Peace and stability in individual littoral states.

- Freedom to all states of the Gulf littoral to exploit their hydrocarbon and other natural resources.

- Freedom of commercial shipping in international waters of the Persian Gulf.

- Freedom of access to, and outlet from, Gulf waters through the Strait of Hormuz.

- The prevention of conflict that may impinge on the freedom of trade and shipping.

India’s Relation with the Persian Gulf Region

- India and GCC:

- The economic and political relationship of India with the GCC has blossomed in recent years. The governments of the GCC members are India-friendly and Indian-friendly.

- The friendly relation has been reflected in the bilateral trade of around $121 billion and remittances of $49 billion from a workforce of over nine million.

- GCC suppliers account for around 34% of India’s crude imports.

- India and Iran:

- India has always shared a friendly relationship with Iran. But the India-Iran relation faces one of the most complex phases at all times due to the USA’s pressure which has politico-economic impacts.

- In May 2018, the USA abandoned the nuclear deal and reinstated economic sanctions against Iran.

- India's Overall Role in the Region:

- India has avoided involvement in local or regional disputes in the region.

- Indian interests do not entail power projection but necessitate peace and regional stability.

Way Forward

- It has been assessed that Saudi Arabia is a fading power whereas UAE, Qatar, and Iran are emerging as the new regional leaders. Oman and Iraq will have to struggle to retain their sovereign identities.

- Thus, Indian interests would be best served if the stability in the region is ensured through cooperative security since the alternative, of competitive security options, cannot ensure durable peace.

Source:

The Hindu

10) Fall in Money Remitted Abroad

- According to data released by the Reserve Bank of India, the amount of money Indians send abroad has witnessed a 61% decline under the Liberalised Remittance Scheme (LRS) as Covid-19 and the lockdown cripple the global economy and ground international travel.

Key Points

- In April 2020, Indians remitted $499.14 million under the Liberalised Remittance Scheme (LRS) — a 61% decline from $1,287.91 million in the same month last year.

- The monthly outward flow in April 2020 is lowest since February 2016 when it was $449.28 million.

- The substantial decline has been recorded in money sent for purchase of immovable property abroad; investment in equity/debt; deposit; gift; medical treatment; and other categories during April 2020.

- A Triple Whammy Effect:

- This dip reflects economic distress, lockdown at home, and curbs on overseas travel.

- Earlier, Resident Indians have remitted a record $18,750 million under LRS in the financial year ended March 31, 2020.

- Despite the outflows reaching a record level during the last financial year, March 2020 saw a dip — $1,358.82 million — against $1,476.82 million in the corresponding month of 2019.

- Money sent for Travel Purposes: The sharpest decline — 71.81% — has been recorded in money sent for travel purposes which came down to $121.13 million in April this year from $429.75 million a year ago.

- This is significant as an estimated 2 million Indian nationals travel overseas every month.

- Money Sent for Studies Abroad: This has also seen a sharp decline of 68.85% — $78.76 million in April this year from $252.84 million in the corresponding month last year.

- Over 7 lakh Indian students pursued studies in foreign institutions in 2018.

- Maintenance of Close Relatives: The category, which contributes the highest amount to total outward remittances under LRS has recorded a decline of 50%— $148.25 million in April this year from $296.14 million last year.

- Deposit and Investment in Equity/Debt: These categories have recorded lesser decline i.e. of 29.91%.

- Donations: The only exception (stands neutral in terms of decline or increase) to other sources of remittances are “donations” e.g. for charity or social service, which contribute a negligible amount to the total outflows.

- Gift and Medical Treatment: While the category “Gift” has recorded a 66% decline in outward remittances, “medical treatment” has seen a decline of 45.85% in April 2020.

- Overall Impact:

- Significantly, the cut in expenses on education, medical treatment, and maintenance of relatives may endure beyond the travel ban and Covid due to financial strain.

- Investment in shares and debt instruments used to buy immovable properties in overseas markets may decline.

- Opening of foreign currency accounts with banks outside India may also get reduced.

- In nutshell, it would affect the currency reserve of the country as an Indian resident needs to buy dollars using the Indian rupees (INR) from an authorized dealer (the bank) in India.

Liberalized Remittance Scheme

- This is the scheme of the Reserve Bank of India, introduced in the year 2004.

- Under the scheme, all resident individuals, including minors, are allowed to freely remit up to USD 2,50,000 per financial year (April – March) for any permissible current or capital account transaction or a combination of both.

- Not Eligible: The Scheme is not available to corporations, partnership firms, Hindu Undivided Family (HUF), Trusts, etc.

- Remitted Money can be used for:

- Expenses related to traveling (private or for business), medical treatment, study, gifts and donations, maintenance of close relatives, and so on.

- Investment in shares, debt instruments, and buy immovable properties in the overseas market.

- Individuals can also open, maintain, and hold foreign currency accounts with banks outside India for carrying out transactions permitted under the scheme.

- Prohibited Transactions:

- Any purpose specifically prohibited under Schedule-I (like the purchase of lottery tickets, proscribed magazines, etc.) or any item restricted under Schedule II of Foreign Exchange Management (Current Account Transactions) Rules, 2000.

- Trading in foreign exchange abroad.

- Capital account remittances, directly or indirectly, to countries identified by the Financial Action Task Force (FATF) as “non- cooperative countries and territories”, from time to time.

- Remittances directly or indirectly to those individuals and entities identified as posing a significant risk of committing acts of terrorism as advised separately by the Reserve Bank to the banks.

- Requirements: The resident individual must provide his/her Permanent Account Number (PAN) for all transactions under LRS made through Authorized Persons.

Comments

Post a Comment